Ho Ho Hold the Rates

The latest policy rate announcement from the Bank of Canada has been a hot topic, stirring discussions among economists, real estate professionals, and everyday Canadians.

The Bank of Canada's commitment to keeping the policy interest rate at 5% represents a strategic move, marking the third pause in a series of rate hikes. The decision is not made in isolation; it's influenced by a myriad of factors, including concerns about decreased affordability and fears of mortgages renewing at higher rates. Despite these worries, the bank emphasizes its dedication to restoring and maintaining price stability for Canadians.

The global economic landscape plays a crucial role in shaping the Bank of Canada's decisions. With a focus on quantitative tightening, the bank aims to normalize its balance sheet amidst a global economic slowdown. Factors such as easing inflation, weakened growth in the United States and the euro area, and lower-than-expected oil prices contribute to the cautious approach.

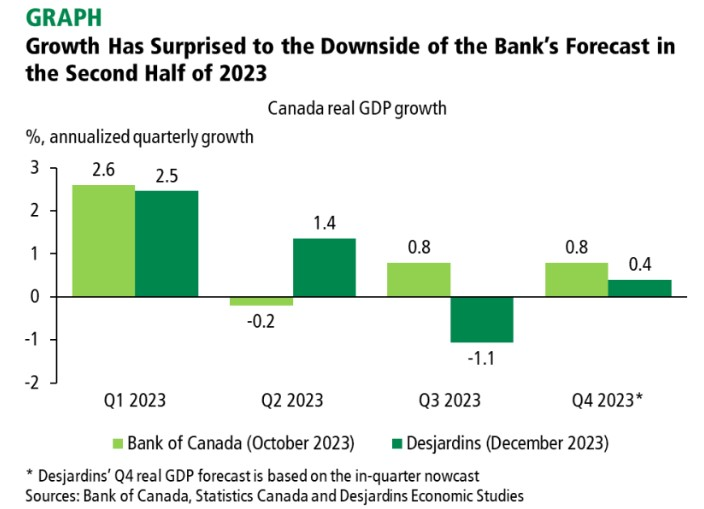

Zooming in on the Canadian economic scenario, we find a mixed bag of indicators. Economic growth has stalled, with real GDP contracting in the third quarter.

Higher interest rates are affecting spending, and the labor market is showing signs of easing. The bank remains vigilant about risks to the inflation outlook, highlighting the need for a delicate balance between demand and supply, inflation expectations, wage growth, and corporate pricing behavior.

Looking ahead, the mortgage rate forecast for Canada in 2023-2024 suggests an initial increase followed by a subsequent decrease. Once a Central Bank has reached its zenith or 'terminal rate,' the historical trend indicates a subsequent move toward rate reduction typically takes six months on average.

While the Bank of Canada plans to hold rates at 5%, an economic slowdown signals lower fixed mortgage rates in late 2023 to early 2024 and a potential central bank rate drop in mid-late 2024. This forecast underscores the importance of strategic mortgage decisions amidst economic changes.

Canadian homebuyers are adopting a wait-and-see approach, anticipating a more substantial decline in home prices. Projections of a 10% drop in the national average through the early part of the next year align with concerns about the housing market, inflation, and the overall economic outlook.

Sellers are slowly adjusting to market conditions, with overall months-of-inventory providing a snapshot of the Greater Toronto Area's real estate landscape. The GTA witnessed an increase in overall months-of-inventory to 3.9 in November, rebounding from a drop below 2 months earlier in the year. Notably, months-of-inventory for detached homes in the GTA has seen a consistent rise since July, while condos in the GTA have hit an inflection point at 5.4 months-of-inventory.

The Bank of Canada's decision to maintain the policy rate at 5%, coupled with a dovish undertone in its statement, sets the stage for potential future adjustments. The central bank acknowledges weak economic data, a contraction in GDP, and softening labor market conditions. The focus on managing inflation and a potential future rate decline suggests a careful approach as the Canadian economy navigates through uncertainties.

In the ever-evolving landscape of finance and real estate, the Bank of Canada's recent decision holds significance for homeowners, prospective buyers, and industry professionals. As we anticipate the next scheduled rate announcement in January 2024, the intricate dance between economic indicators, inflation, and policy decisions continues. Stay tuned for further insights into the economic trajectory and potential adjustments in the Bank of Canada's stance.

Your market

Curious where our market falls on this split and what it means for you?

Get in touch, and we’ll tell you everything you need to know.