The Not-So Hidden Recession: Corporate Struggles and Consumer Woes

The global economy is navigating through a period of significant challenges as we progress through 2024. Recent corporate earnings calls and economic data reveal a complex picture of weakening consumer demand, a spreading "goods recession," and shifting corporate strategies. This article delves into these themes and transitions to a discussion about the Canadian market, incorporating insights from recent data and transcripts.

Weakening Consumer Demand

The slowdown in consumer spending is becoming increasingly evident across various sectors. Major companies like Nestle and Unilever have reported weaker sales growth. Nestle, for instance, has downgraded its sales growth projection for 2024 from around 4% to just 3%. This adjustment comes as consumers opt for cheaper brands due to inflation-driven price increases. Similarly, the automotive sector is experiencing inventory buildup due to flagging sales, a stark contrast to the supply shortages seen in recent years.

The Goods Recession

The concept of a "goods recession" is gaining traction as it spreads across different industries. This phenomenon is characterized by declining sales figures for physical products, as opposed to services. The S&P 500 companies' second-quarter results reflect this trend, with only 43% of reporting companies beating revenue expectations – the lowest reading in at least five years. This slowdown is particularly evident in commodity markets, where prices for crude oil, gasoline, silver, aluminum, and steel have seen significant declines, indicating weakening global demand.

Pricing Pressures and Corporate Strategies

Companies are finding it increasingly difficult to pass on price increases to consumers. Many businesses that previously relied on price hikes to drive growth are now facing resistance. Nestle's recent earnings report highlights this challenge, as the company's results over the past year have been driven almost entirely by price expansion. However, this strategy is becoming unsustainable as consumers, facing financial pressures, opt for cheaper alternatives. As Mark Schneider, Nestlé CEO, remarks, "...we have seen pricing come down faster than expected. Therefore, we consider it prudent to adjust our guidance for the year, with organic sales growth now expected to be at least 3%."

In contrast, Unilever has adopted a different approach. By slowing down price increases and focusing on volume growth, the company has managed to expand its margins. Unilever reported a price growth of just 1% in the latest quarter, compared to 8.2% in the same quarter of 2023. This strategy aims to win back customers who had been driven away by previous price hikes.

Declining Saving Rate and Income Pressures

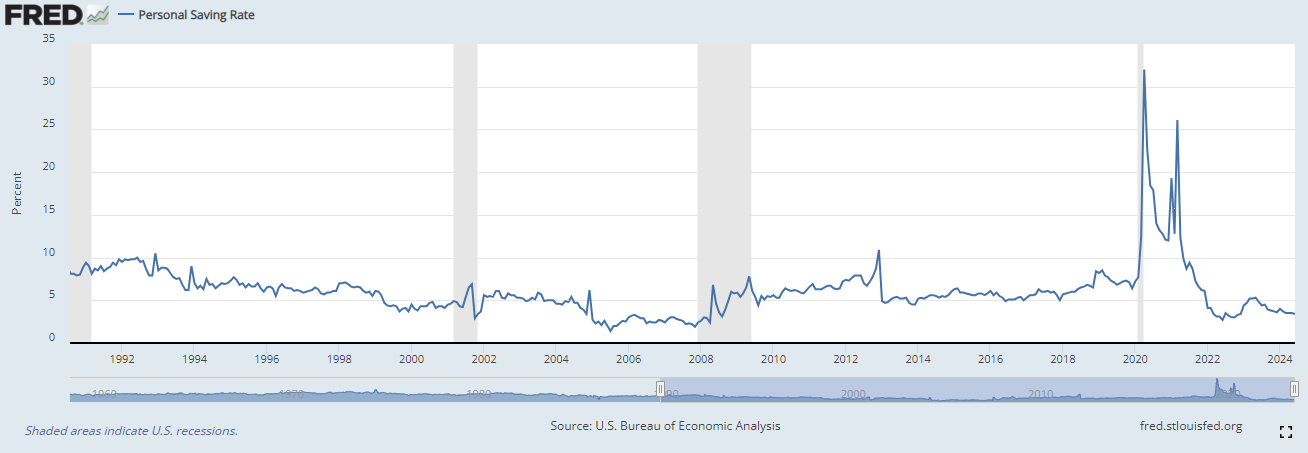

The US savings rate has tumbled to 3.4%, indicating that consumers are depleting their savings to maintain spending levels. This trend is unsustainable and suggests that consumer spending may face further pressure in the coming months. Moreover, incomes are not keeping pace with inflation, putting additional strain on household budgets and spending power.

Global Economic Concerns

The economic challenges are not limited to the United States. China's economic slowdown is causing ripple effects across global markets. While Canada has few direct trade links with China, certain sectors, particularly minerals, are exposed to China's sputtering economy. This global interconnectedness means that economic headwinds in one region can quickly translate to challenges in others.

Employment Concerns

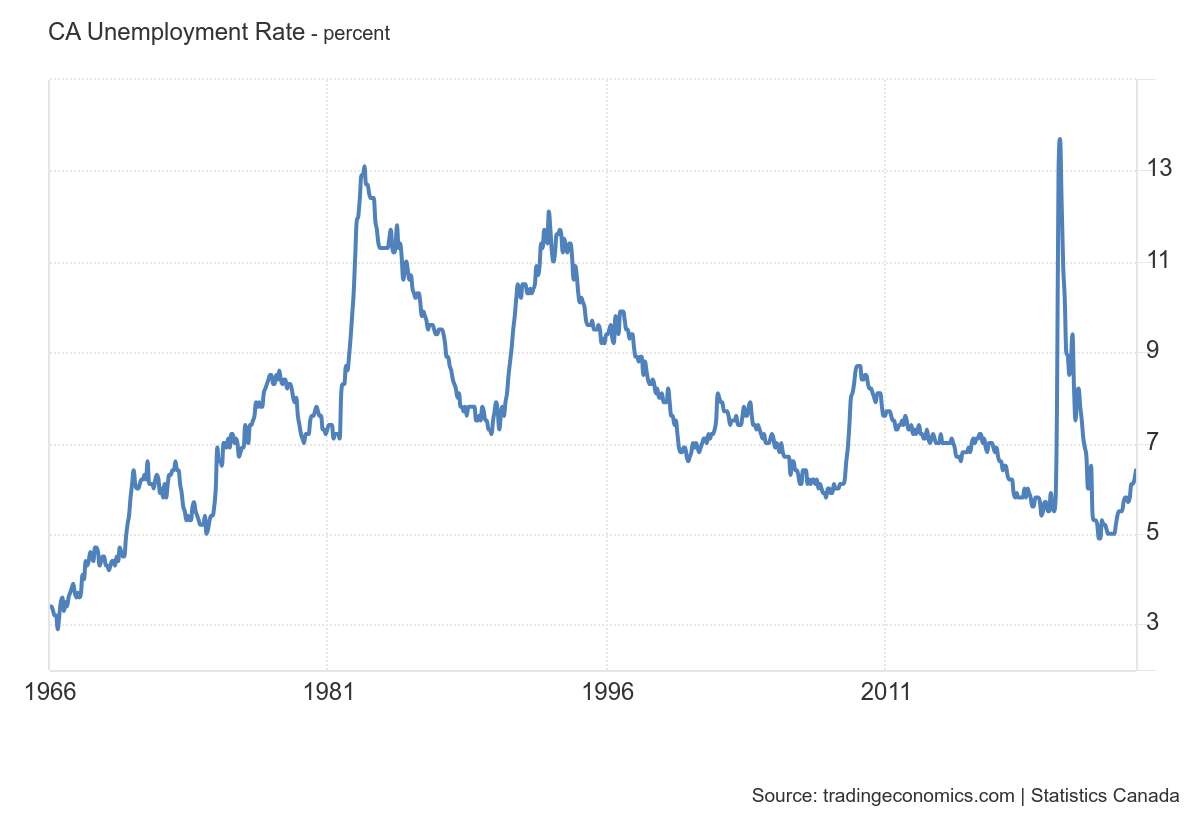

The labor market, which has been a bright spot in many economies, is showing signs of softening. Companies are becoming more cautious about hiring, and consumers are increasingly worried about future employment prospects. In Canada, the unemployment rate is rising at a pace consistent with previous recessions, although the nature of this increase is different. Instead of a surge in layoffs, it's taking longer to absorb new workers into the workforce as the population grows rapidly.

Shift in Corporate Focus

As top-line growth becomes more challenging, many companies are pivoting their strategies to focus on managing their bottom line through cost-cutting and efficiency measures. Unilever's recent performance exemplifies this shift, with the company being rewarded by the stock market for its margin expansion despite disappointing sales figures.

Divergence Between Economic Data and Corporate Reality

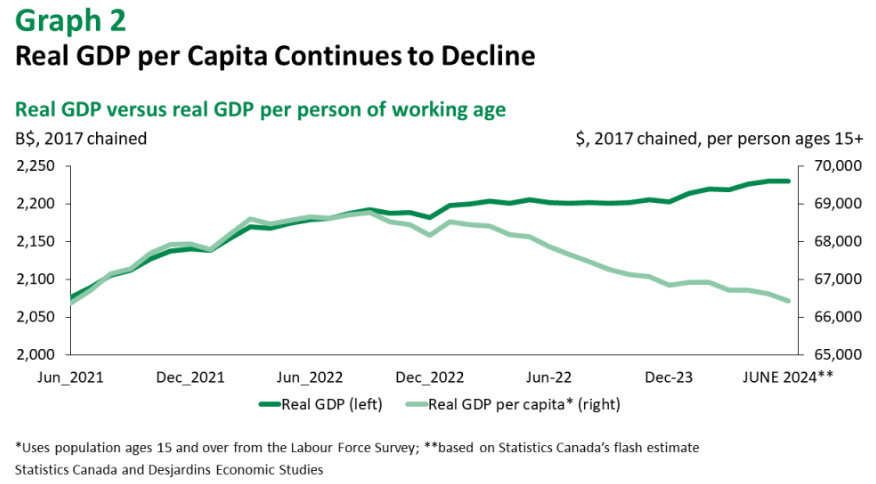

While some headline economic indicators might appear positive, the on-the-ground reality for businesses and consumers is more challenging. This divergence is evident in the recent GDP reports, where solid headline growth figures mask underlying weaknesses, particularly on a per-capita basis.

Canadian Economic Landscape

Shifting our focus to the Canadian market, recent data reveals a nuanced economic picture. Canada's GDP expanded by 0.2% in May 2024, following a 0.3% increase in April. This growth was slightly higher than both Statistics Canada's preliminary estimate and market expectations. The advance estimate for June indicated a further 0.1% increase, rounding to a GDP increase of approximately 2% for Q2 2024.

Sectoral Performance in Canada

The goods-producing sector in Canada outpaced the services-producing sector in May, with growth of 0.4% and 0.1% respectively. Manufacturing was a key driver, with output rising by 1%. Non-durable manufacturing saw a 1.4% increase, partly due to a rebound in petroleum refineries following scheduled maintenance in the previous month.

Other notable sectoral developments include:

- A 7.1% jump in potash mining GDP after four consecutive monthly declines

- A 1.6% increase in supporting activities for mining

- Contractions in retail (-0.9%) and wholesale sales (-0.8%)

- Continued expansion in educational services (+0.5%) and health care and social assistance (+0.3%)

Per Capita GDP Concerns

Despite the overall GDP growth, per capita GDP in Canada continues to decline. The May data suggests that Q2 2024 will mark the seventh out of eight quarters with a decline in per-person GDP, a streak not previously seen outside of a recession. This trend underscores the challenges faced by the Canadian economy, as population growth outpaces economic expansion.

Monetary Policy Outlook

The economic backdrop in Canada suggests room for further interest rate cuts by the Bank of Canada (BoC). Analysts expect a total of 100 basis points of cuts to the overnight rate in 2024, including the 50 basis points already delivered in June and July. The BoC's outlook for GDP remains more optimistic than many analysts', largely due to differences in forecasts for population growth trajectory.

Comparative Analysis: US and Canada

While both the US and Canadian economies are facing headwinds, there are notable differences in their situations. The US consumer spending has shown more resilience, partly due to Americans being less sensitive to higher interest rates and drawing down on savings to fuel the economy. In contrast, Canadian households have been pulling back on spending.

Canada's economic performance has been lagging behind the US since 2023, which is unusual given the close cross-border economic ties. However, this divergence might allow the Bank of Canada to cut interest rates earlier than the US Federal Reserve in 2024.

Immigration and Labor Force Participation

One bright spot in the Canadian economy is the contribution of immigrants to the workforce. Immigrants are outperforming their Canadian-born peers in terms of labor force participation, especially those aged 55 and above. This trend is helping to mitigate some of the demographic pressures faced by the Canadian economy.

Housing Market Pressures

The housing market remains a significant concern in Canada. With more than two-thirds of Canadian households unable to buy a home, homeownership has never been more out of reach. Renters are devoting a greater share of their take-home income to housing costs and face higher hurdles to accumulating wealth compared to homeowners.

Looking Ahead

As we navigate through these economic headwinds, it's clear that both the US and Canadian economies face significant challenges. The goods recession, weakening consumer demand, and shifting corporate strategies are reshaping the economic landscape. In Canada, while headline GDP figures show growth, the decline in per-capita GDP and the pressures in the housing market paint a more complex picture.

Businesses and policymakers will need to remain agile, adapting to changing consumer behaviors and global economic trends. For consumers, the coming months may require careful financial planning as employment concerns and housing pressures persist.

The divergence between economic data and corporate reality underscores the importance of looking beyond headline figures to understand the true state of the economy. As we move forward, monitoring these trends and their impacts on both the broader economy and individual sectors will be crucial for navigating the uncertain economic waters ahead.

Not sure if you should sell?

We get it. The market is weird. If you’re not sure if selling your home is the right move for you right now, get in touch. We’ll go over the details of your specific situation and help you make the right decision.