Volatility in the Canadian Housing Market: 60 per cent decline in total housing starts in June

The Canadian housing market is a dynamic and multifaceted sector that plays a crucial role in the economy. Building permits and housing starts serve as key indicators of this market's health, reflecting both current trends and future potential. As we delve into the data from June 2024, we will explore the implications of these figures, particularly focusing on the Greater Toronto Area (GTA) and comparing them to previous months and years.

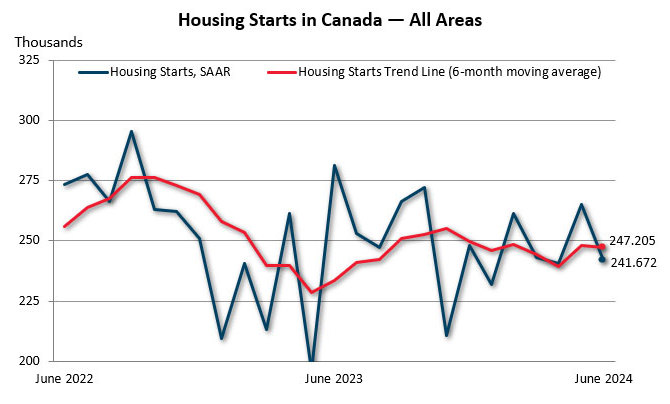

In June 2024, the total seasonally adjusted annual rate (SAAR) of housing starts in Canada decreased by 9%, falling to 241,672 units from 264,929 in May. This decline is part of a broader trend, with the six-month moving average also showing a decrease of 0.4%, down to 247,205 units. The actual number of housing starts in urban centers with populations over 10,000 dropped 13% year-over-year to 20,509 units compared to 23,518 units in June 2023.

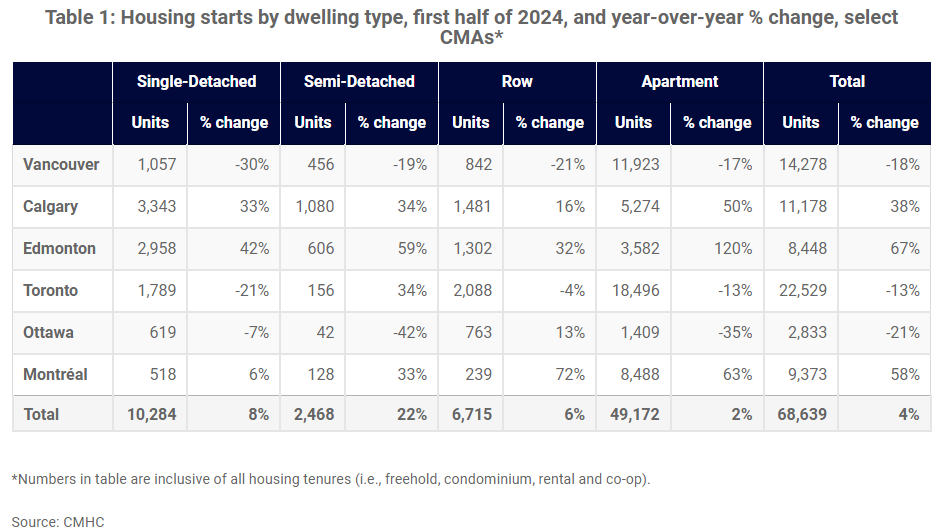

A significant factor in this decline was the 16% drop in multi-unit starts, while single-detached starts remained relatively stable compared to the previous year. Notably, Toronto experienced a staggering 60% decrease in housing starts, while Vancouver saw a 55% decline. In contrast, Montréal reported a remarkable increase of 226%, driven by a surge in multi-unit construction.

The landscape of housing starts varies significantly across Canadian cities. For instance, while Toronto and Vancouver faced notable declines, cities like Calgary and Edmonton reported increases. In Calgary, total housing starts rose by 38%, and Edmonton experienced an impressive 67% growth. This divergence highlights the shifting dynamics within the Canadian housing market, where some regions are thriving while others are struggling.

In Toronto, the breakdown of housing starts reveals that single-detached units decreased by 21%, while multi-unit starts plummeted by 13%. This trend is indicative of the challenges facing the GTA, where high interest rates and declining condominium pre-construction sales are impacting the market negatively.

Bob Dugan, Chief Economist at the Canada Mortgage and Housing Corporation (CMHC), noted, “The higher interest rate environment appears to have caught up with some of Canada’s major centres as lower multi-unit starts... drove both the SAAR and Trend down in June.” This statement underscores the critical role that building permits play in shaping the construction landscape, as they reflect developers' confidence and willingness to invest in new projects.

Several factors contribute to the fluctuations in housing starts across Canada. The current high interest rate environment is a significant driver, affecting affordability and buyer sentiment. As interest rates rise, potential homebuyers may delay their purchases, leading to a decrease in demand for new housing.

Additionally, demographic trends, such as population growth and urbanization, continue to influence housing demand. In the GTA, the influx of new residents has historically fueled housing starts. However, the current economic climate is causing a shift, with many developers reassessing their projects in light of rising costs and uncertain market conditions.

When comparing the current trends in building permits to previous years, it is evident that the landscape has changed dramatically. The decrease in housing starts in June 2024 mirrors a broader trend observed since early 2023, where rising interest rates and economic uncertainty have led to a slowdown in construction activity.

In June 2023, Canada recorded a total of 23,518 housing starts in urban centers, while June 2024 saw that number drop to 20,509. This represents a significant year-over-year decline, highlighting the challenges faced by the construction industry.

The fluctuations in housing starts and building permits have profound economic implications. A decline in construction activity can lead to job losses in the construction sector, affecting not only builders but also suppliers and related industries.

Furthermore, reduced housing supply can exacerbate affordability issues, particularly in high-demand areas like the GTA. As housing starts slow, the supply of new homes diminishes, potentially driving up prices for existing homes. This scenario poses challenges for first-time homebuyers and low-income families, further complicating the housing crisis in Canada.

Looking ahead, the outlook for housing starts and building permits in Canada remains uncertain. While some regions, such as Calgary and Edmonton, are experiencing growth, major urban centers like Toronto and Vancouver are facing significant challenges.

As interest rates continue to influence the market, it is likely that we will see continued downward pressure on housing starts throughout 2024. The CMHC's upcoming Housing Supply Report, expected in the Fall, will provide further insights into these trends and their implications for the Canadian housing market.

Housing starts in Canada cannot be overstated. The data from June 2024 reveals a complex landscape marked by significant declines in major urban centers like Toronto and Vancouver, contrasted by growth in other regions. As we navigate these challenges, it is essential for stakeholders to remain informed and adaptable to the evolving market conditions.

The Canadian housing market is at a crossroads, and understanding the dynamics of building permits and housing starts will be crucial for future planning and policy decisions.

Thinking about selling your home?

Get in touch. We'll guide you through every step of the process to ensure a smooth transaction that meets your goals.